All the rate changes, except those for tobacco and tobacco-related products, will come into effect from September 22, the first day of Navratri, said Union Finance Minister Nirmala Sitharaman who chaired the meeting that was attended by ministers from 31 states and Union Territories.

Story continues below this ad

What was supposed to be a two-day meeting got wrapped up in a single day, despite revenue loss concerns flagged by multiple states before the proceedings got underway.

Prime Minister Narendra Modi, according to a statement from the PMO, expressed happiness that the GST Council, comprising the Union and the States, had collectively agreed to the proposals submitted by the Union Government on GST rate cuts and reforms, which will benefit the common man, farmers, MSMEs, middle-class, women and youth.

“The wide ranging reforms will improve the lives of our citizens and ensure ease of doing business for all, especially small traders and businesses,” Modi said.

The GST Council announced sweeping rate cuts for common-use items ranging from packaged and branded food items like fruit juices, butter, cheese, condensed milk, pasta, packaged coconut water, soya milk drinks, nuts, dates and sausages, and medical items including medical grade oxygen, gauze, bandages, diagnostic kits (5 per cent from 12 per cent) to nil GST rate for ultra-high temperature milk, chhena or paneer, pizza bread and khakra, plain chapati or roti and education item of erasers from 5 per cent at present.

Source: CBIC

Source: CBIC

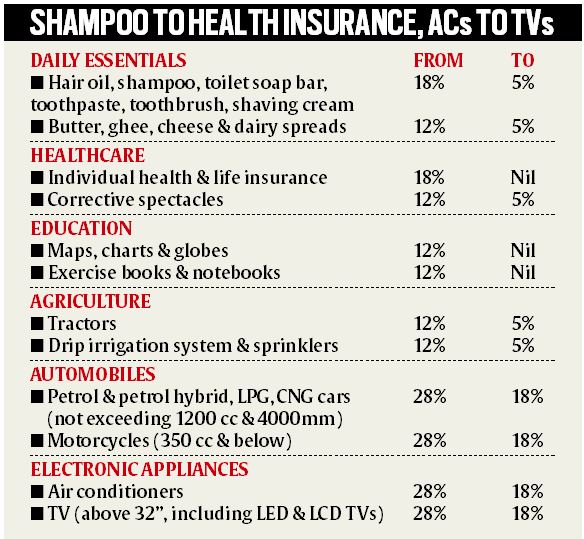

Other common use items that have also seen GST being reduced to 5 per cent from either 12 per cent or 18 per cent include items such as hair oil, soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware and other household articles.

GST has also been reduced for white goods such as air conditioners, television sets, dishwashing machines to 18 per cent from 28 per cent. Small cars with engine capacity not exceeding 1200 cc (petrol) and 1500 cc (diesel) and with length not over 4 metre will now be in the 18 per cent slab. There is also going to be tax relief for motorcycles with engine capacity less than 350 cc and all automotive parts that will now be taxed at 18 per cent. Bigger cars will be taxed at 40 per cent. The GST rate on all electric vehicles will remain unchanged at 5 per cent.

Another key decision was regarding the blanket exemption provided for life insurance, whether term or life, ULIP or endowment policies for individuals along with exemption for health insurance for individuals including family floater plans and policies for senior citizens. Beauty and physical well-being services used by common people such as services of gyms, salons, barbers and yoga centres will now face a lower GST of 5 per cent as against 18 per cent at present.

With these reforms, the GST will now get rid of the multiplicity of slabs – 5 per cent, 12 per cent, 18 per cent and 28 per cent – with a broad two-slab structure – a merit rate of 5 per cent and a standard rate of 18 per cent – in addition to a special demerit rate of 40 per cent for super luxury, sin and demerit goods such as pan masala, tobacco and cigarettes.

Story continues below this ad

The streamlining of slabs will help in correction of inverted duty structure – where the tax rate on output supply is lower than the tax rate on inputs and which was affecting the working capital and cash flow of businesses – and numerous classification disputes arising because of the multiplicity of rates and differential rates for similar items, especially in the automotive and food sectors.

“The honourable Prime Minister actually set the tone for the next generation reforms on the 15th of August when he spoke from the Red Fort… This reform is not just on rationalising rates. It’s also on structural reforms. It’s also about ease of living so that businesses can do their business of working together with the GST with great ease. We have corrected inverted duty structure problems, we have resolved classification related issues, and we have ensured that there will be stability and predictability about the GST. Rate rationalisation, of course, we have reduced the slabs: there shall be only two slabs and we are also addressing the issues of compensation cess,” Sitharaman told reporters after the meeting.

She said that these reforms have been carried out with a focus on the common man. “Every tax levied on common man’s daily use items has gone through a rigorous look into. And, in most cases, the rates have come down drastically. Labour-intensive industries have been given good support. Farmers and agriculture as a whole will also benefit by the decisions we have taken today; health related also will benefit. So, the key drivers of the economy have been given prominence,” she said.

Referring to the imposition of tariffs on India by the US, Sitharaman said, “The tariff turmoil is not a matter which influenced the GST reform, because we have been at it now for more than one-and-a-half years. Some Group of Ministers was working on rate rationalisation, some other Group of Ministers, a bit later, was working on insurance, and so on. And compensation cess was a reality, that it is going to end the moment you paid back the loans. None of this has anything to do with the tariffs.”

Story continues below this ad

States are learnt to have raised revenue loss concerns in the meeting, with some pegging it to be around Rs 80,000 crore to Rs 1.5 lakh crore. Some of the states are learnt to have raised the option of voting on certain issues in the Council meeting. However, in the end, no voting was carried out and the decision was arrived at with consensus in the larger spirit of implementing the pro-people proposal, officials said.

Revenue Secretary Arvind Shrivastava said that the proposal is “fiscally sustainable” and will result in a net revenue implication of Rs 48,000 crore. “We have estimated a figure. We expect that the net fiscal implication – we would not call it a revenue loss because that doesn’t seem to be the correct terminology – but net revenue implication of this proposal is expected, we have estimated it to be around Rs 48,000 crore. This is on the consumption base of 2023-24, because that is where we had all the segregated data,” he said.

The long-pending correction of inverted duty structure has also been carried out for textiles and fertiliser sectors. GST cuts were announced for the manmade textile sector, with manmade fibre seeing the tax rate being cut to 5 per cent from 18 per cent and manmade yarn to 5 per cent from 12 per cent. For the fertiliser sector, GST has been reduced on inputs such as sulphuric acid, nitric acid, and ammonia to 5 per cent from 18 per cent.

The industry welcomed the GST rate rationalisation and other reforms, assuring to pass on the benefits of the rate cuts to common people.

“CII not just welcomes the GST Council’s forward-looking decisions – moving to two rates of 5% and 18% from 22 September, simplifying refunds and MSME procedures, and exempting individual life and health insurance from GST – but also sees this as pathbreaking. This clarity will ease compliance, reduce litigation, and give businesses and consumers the predictability they need. By lowering rates on everyday items and critical inputs, the reforms provide immediate relief to families and strengthen the foundation for growth. CII strongly holds the view that Industry would swiftly pass benefits to the consumers and partner with the Government to ensure a smooth, timely rollout that lifts demand and supports jobs,” Chandrajit Banerjee, Director General, Confederation of Indian Industry (CII) said.