As of today, the last date to file your income-tax return is September 30. It is likely that the deadline will be extended, given the glitches in the new income-tax return-filing portal and the deadline given to the website developer Infosys to solve all the problems being September 15.

On your part, however, you can carry out the basic checks to ensure that you are ready to file your returns as soon as the glitches are sorted out. You can start getting your documents – Form-16, bank and capital gains statements – in order before commencing the actual process. Another crucial document that you need to verify in advance is the Form 26AS, also called the tax credit statement or the annual information statement.

You can access it by logging into the income tax return portal and downloading it. Here’s an explainer to understand why verifying Form 26AS is critical to your return-filing process.

Form 26 AS, which was revamped last assessment year (2020-21) to capture high-value transactions, contains details of your taxes deducted and deposited.

For a salaried employee, your employer will deduct the tax payable every month. If you have fixed deposits, your bank will do the same before crediting the interest proceeds to your account upon maturity. Any advance tax or self-assessment tax paid will also be displayed in your Form 26AS. “It also contains information relating to demand and refund against the PAN of a tax-payer. While preparing the income tax return (ITR), a taxpayer must tally the income details and tax deducted shown against such income in the Form 26AS with the details as per her records,” says Sandeep Sehgal, Director, Taxes and Regulatory, AKM Global, a tax and consulting firm.

Check specified financial transactions

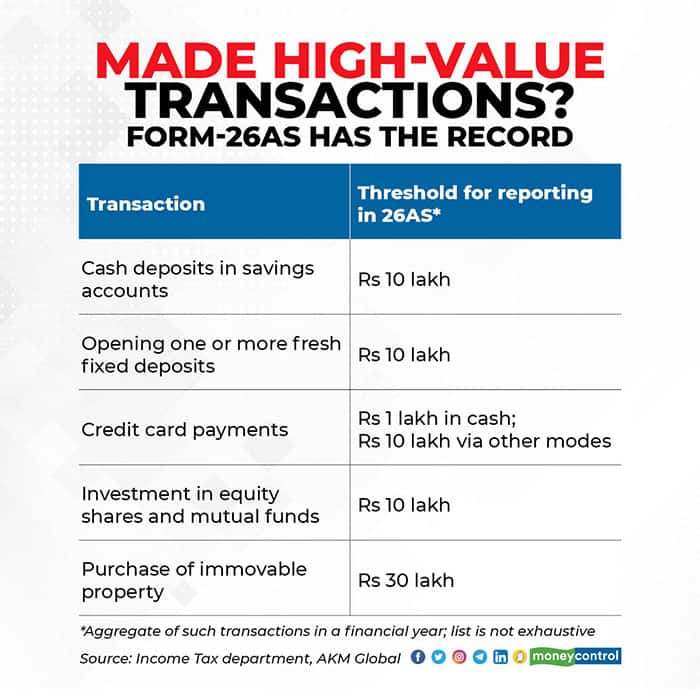

The statement has evolved over time to reflect certain high-value transactions – termed specified financial transactions (SFT) too (see graphic). Cash deposit, purchase and sale of shares, units, bonds, debentures, property details (beyond the specified thresholds) will be reflected in the statement. For example, cash deposits of over Rs 10 lakh in your savings accounts in a financial year. Similarly, if you purchase a property worth over Rs 30 lakh, it will show up in this statement.

Why is Form 26AS so important?

Comparing the details in the form and your bank statement, Form-16 is a must before filing your ITR. “This will minimise the chances of mismatch and also the errors on account of omission of certain transactions while filing the ITR,” says Sehgal. Any mismatch can lead to queries and even notices from the income-tax department. “Verifying the details will help you avoid further litigation,” says Surana.

Broadly speaking, the income-tax department aims to generate your income details automatically in pre-filled forms. This is work in progress. “You can import the details of Form 26AS directly in his income tax return by way of auto-population. The data being readily available provides ease to the taxpayer in reconciling and reporting the necessary financial transactions in their tax return appropriately. Thus, Form 26AS acts a tool for the taxpayers which prevents any under-reporting or mis-reporting of transaction details in the income tax returns,” says Suresh Surana, Founder, RSM India.

What if Form-16 and Form 26AS details do not match?

A close scrutiny will help you discover any discrepancies and also the reasons for the same.

“If there is a mismatch in either the quantum of income or the TDS, the only way to rectify the error in form 26AS is to inform the deductor (employer, bank, etc.) and ask it to file a rectified TDS return. The deductee cannot himself make any corrections in the form 26AS,” says Sehgal.

It would be unwise to attempt making changes manually on your own; the income tax department could then ask for explanations for your action. The income tax portal, too, provides the option to raise your complaint under the grievances tab (see graphic).

|