DIRECT TAX collection for the current financial year has exceeded the revised estimates, presented by Finance Minister Nirmala Sitharaman in the Budget, signalling a recovery in the economy.

As per tax data accessed by The Indian Express, direct tax collection, as of March 16, stood at Rs 9.18 lakh crore, about Rs 18,000 crore higher than the revised estimates.

This surge in tax mop-up was led by a rise in advance tax collection from companies. Overall, corporation tax collection jumped nearly 7 per cent from a year ago to Rs 4.7 lakh crore as of March 16. This is higher than the revised estimate of Rs 4.46 lakh crore projected by the Finance Ministry.

On the other hand, income-tax collection of Rs 4.21 lakh crore is still short of the revised estimates of Rs 4.59 lakh crore. The overall direct tax collection of Rs 9.18 lakh crore, while beating the revised estimates, is 4 per cent lower than the year-ago figure. This, however, is a huge improvement from the 20-per cent decline seen at the beginning of the year during the height of the Covid pandemic.

With another two weeks to go for the fiscal year to close, tax authorities expect collection to rise significantly. In the Mumbai circle, they expect to garner at least Rs 10,000 crore revenues till March 31. In the last financial year, overall direct tax collection went up by about Rs 72,000 crore.

What gives confidence to the taxman is the revival in profitability of Corporate India. As per a Reserve Bank of India analysis of earnings of listed non-financial non-government firms, sales in December quarter grew for the first time in six quarters by 4 per cent. Similarly, their operating profit stood at a record 22.6 per cent, as against 18.3 per cent a year ago. This has prompted analysts to upgrade earnings expectations of India Inc across sectors. For example, Kotak Institutional Equities has said the net profit of Nifty50 companies will be 20 per cent in FY21, compared to 12 per cent earlier.

All this will lead to a buoyancy in direct tax collections. With Goods and Services Tax (GST) revenues exceeding Rs 1 lakh crore for the last three months and expectations of it to hit a record Rs 1.3 lakh crore in March, the worst impact of the pandemic seems to be over.

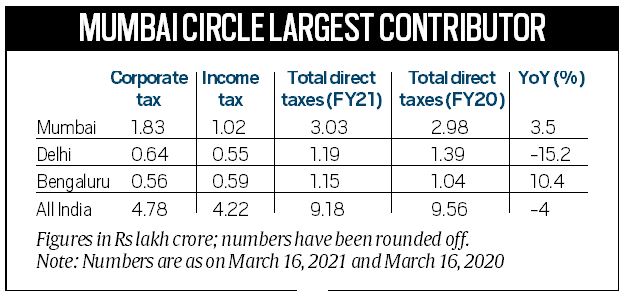

The Mumbai circle continued to be the largest contributor to direct tax collections. In FY21, it has collected Rs 3.03 lakh crore as of March 16, up 3.5 per cent over a year ago. The Bengaluru circle, which collected Rs 1.15 lakh crore of direct taxes, saw highest growth of 10.4 per cent from a year ago. This could be owing to the better compliance as well as the performance of the software sector, which has weathered the pandemic well, said sources. The only other circle that registered a positive year-on-year growth in tax collections was Jaipur.

|