If you have filed your income tax returns for the assessment year 2021-22 before December 31 but are yet to complete the verification process, you need to do so as soon as possible.

No verification, no processing of returns

Though you can verify your returns within 120 days from having file your income tax returns online, some tend to forget the final, yet key, step in the return-filing process. The income tax department, in its December 28, 2021 circular, pointed out that a number of e-returns for assessment year 2020-21 were pending for processing as they were not ‘verified’.

So, it provided a window of up to February 28, 2022 to such tax-payers, except those against whom the I-T department has already initiated some action, to complete the process. Without the extension, such tax-payers might have had to make representations to justify the delay. “Essentially, when you verify the returns, you provide a confirmation of the information you have submitted. It is not a matter of choice, but a necessary step,” explains Sudhir Kaushik, Co-founder and CEO, TaxSpanner.com.

And skipping this step has consequences. For one, until it is verified, it will not be taken up for processing by the income tax department – so, if you have a refund due for excess taxes paid, it will be delayed. “More importantly, failure to verify your return (during the 120-day period) can result in the tax department treating it as invalid return,” says Chetan Chandak, Director, TaxBirbal, a tax consultancy firm.

Rectifying any errors in your original return will also be difficult. “You will have to refile the return and it may be treated as a belated return and can attract the additional interest of 1 percent per month under section 234A,” he adds. In such cases, you will have to pay the price for filing belated returns. For instance, if you have incurred any losses that can be set off against the current financial year’s income, thus reducing your tax outgo, you will not be able to do so. “You will not be able to carry forward the losses and adjust them in future years. Non-verification of return on time effectively means you have not filed the return within the due date,” says Chandak.

E-verification in a few clicks, minutes

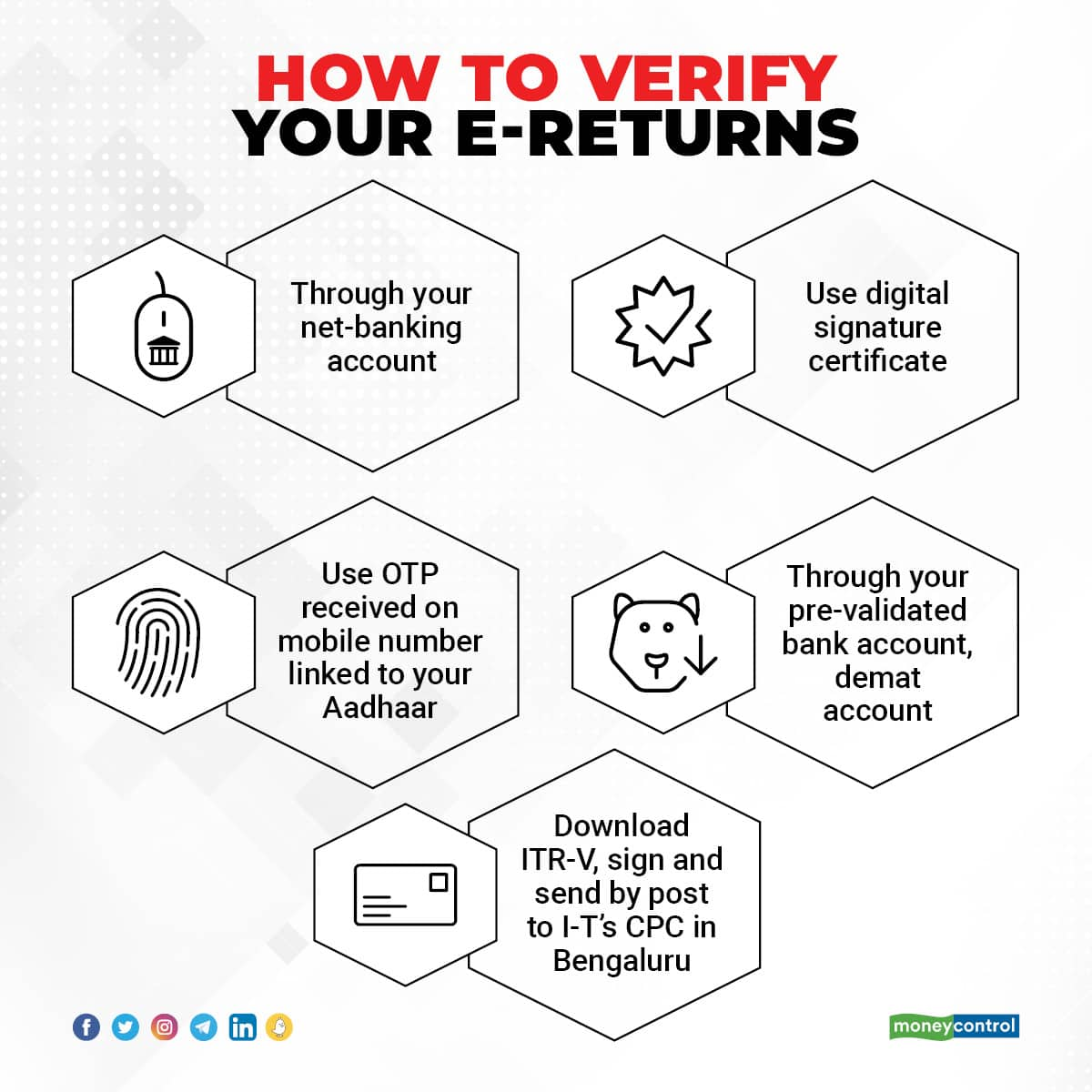

You have two modes for verifying the returns – physical and electronic. The traditional, physical mode involves downloading form ITR-V (acknowledgement) form – either from the income tax return e-filing website or the acknowledgement email sent to you – signing it and sending it by post to the tax department’s central processing centre in Bengaluru. However, the electronic mode is simpler and quicker too.

And, this mode offers several options. You can log on to the e-filing portal, use your Aadhaar number to generate an OTP to complete the process or do it through your netbanking account. You can also generate an electronic verification code (EVC) using your pre-validated bank account, demat account or Bank ATM. “Alternatively, you can simply use DSC (digital signature certificate) to e-verify your e-returns. It is not expensive and enables you to seamlessly complete the process seamlessly,” says Kaushik.

Once you are through with the exercise, the portal will display a message to confirm successful completion. The income tax department will also send an email to your registered email ID.

|