In these uncertain times, when volatility rules equity and debt markets, a bank fixed deposit offers some solace. Investors prefer fixed deposits (FDs) as returns are certain. Those in the lower tax brackets find bank FDs especially attractive, as the chances of losing their principal are negligible and the tax outgo is lower.

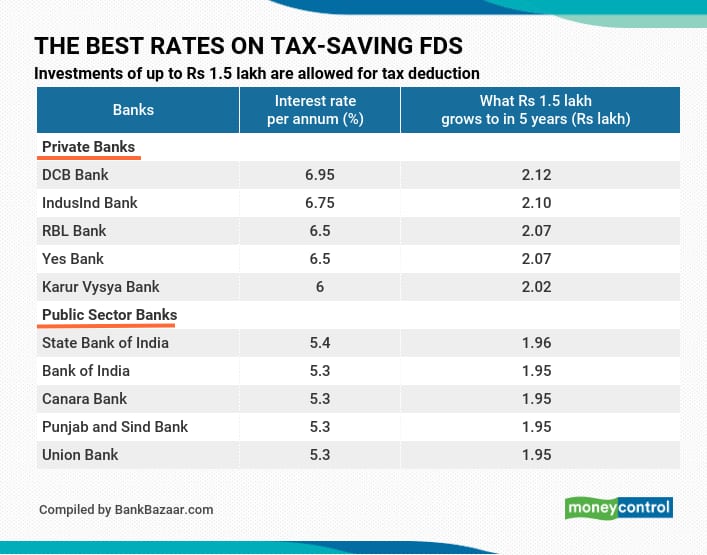

Tax-saving FDs are very popular with customers. Certain conservative investors prefer these FDs for taking the section 80C tax deduction benefit. Investments up to Rs 1.5 lakh can be claimed for tax deduction under section 80C of the income tax act. Tax-saving FDs have a lock-in period of five years and premature withdrawals are not allowed.

Even though bank FD rates have fallen to low levels, there are some banks that offer you reasonably high rates.

Smaller private banks offer higher interest

Smaller private banks offer interest rates of up to 6.95 percent on tax-saving FDs, according to data compiled by BankBazaar. These are higher compared to leading public sector banks.

DCB Bank tops the chart with 6.95 percent interest, followed by private banks such as IndusInd Bank, RBL Bank, Yes Bank and Karur Vysya Bank that offer 6-6.75 percent interest on FDs.

Private Banks such as Axis Bank, ICICI Bank and HDFC Bank offer 5.50 percent, 5.35 percent and 5.30 percent interest respectively on tax-saving FDs.

The highest rate offered by a public-sector bank on a five-year tax-saving FD is from State Bank of India (SBI) that offers 5.40 percent interest, followed by Bank of India and Canara Bank offering 5.30 percent interest on tax savings FDs. Bank of Baroda is offering 5.25 percent interest on tax-saving FDs.

A sum of Rs 1.5 lakh invested in DCB Bank and SBI tax-saving FDs grows to Rs 2.12 lakh and 1.96 lakh, respectively, after five years.

Smaller private banks that have a low customer base typically offer higher rates to attract customers and depositors. That’s why government-owned banks offer lower rates. Just because a bank is offering you a high rate, you shouldn’t rush to invest in it. Go for higher rates, but also go for reasonably larger banks with a strong managements and financials.

Data compiled is as on November 18, 2020 from respective banks' websites. BankBazaar has accounted for FDs belonging to only those foreign, private, small finance and public sector banks that are listed on the stock exchanges. Banks, for which data is not available on their respective websites, were dropped.

|