The tax returns filing for income earned during the financial year 2016-17 will be on in full swing soon. The company would have handed over the Form 16 of their employees. Companies and self-employed too will be filing their tax returns as per their deadlines.

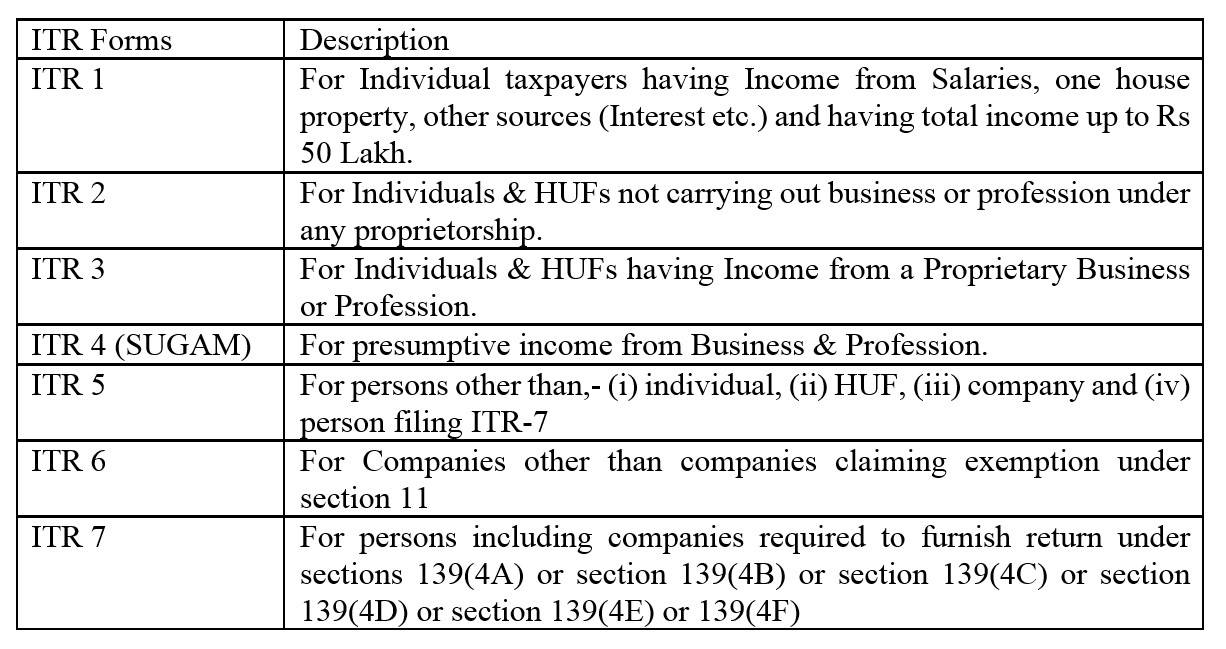

As you prepare to file your income tax, one of the basic things you should know is which tax form should you use to file your returns. The Income Tax Department has specified different tax returns form for a different class of taxpayers.

Here are the relevant forms you need to use for filing your income tax returns (ITR) The forms for different categories of persons are as follow:

“Income Tax Return (ITR) is a statement of income earned by a person in a financial year. The person (other than Company & Firm) whose total income exceeds the specified threshold limit in a financial year is to file income tax return for that financial year,†says Gaurav Talwar, Partner, Felix Advisory “Income Tax Return (ITR) is a statement of income earned by a person in a financial year. The person (other than Company & Firm) whose total income exceeds the specified threshold limit in a financial year is to file income tax return for that financial year,†says Gaurav Talwar, Partner, Felix Advisory

Talwar points out as per section 139 of Income Tax Act, 1961 (IT Act), every person whose total income exceeds the following specified limits is required to file income tax return. The limits for an individual person are as follows:

Sudhir Kaushik, co-founder and CFO, Taxspanner.com, advises being extra-careful while filing tax returns and wrong entries could be taken as concealment of income by the tax department. “The income tax return form is a legal declaration and a binding document in which ignorance or casual mistakes are equivalent to “income concealmentâ€. Hence, the minimum return clearance criteria for seamless processing of ITR would be matching data,†Kaushik said.

Also watch: Filing income tax returns? 10 key points to remember

He also pointed out that tax return filed by the assessee has to have minimum prescribed income/loss details. It must reconcile with the information already available with the department.

|