A gong sound at midnight in Parliament’s central hall will mark the switchover to Goods and Services Tax (GST).

Here’s all that you wanted to know about GST, independent India’s biggest reform initiative.

It will kick in from July 1, ending more than 11 years of hectic confabulations among the Centre and the states shepherded by several Union and state finance ministers, and withstanding testy relations often marked by political brinkmanship.

What is it?

- GST is India’s most ambitious indirect tax reform plan

- It aims to stitch together a common market by dismantling fiscal barriers between states.

- It is a single national uniform tax levied across the country on all goods and services.

- It will be implemented from July 1, 2017

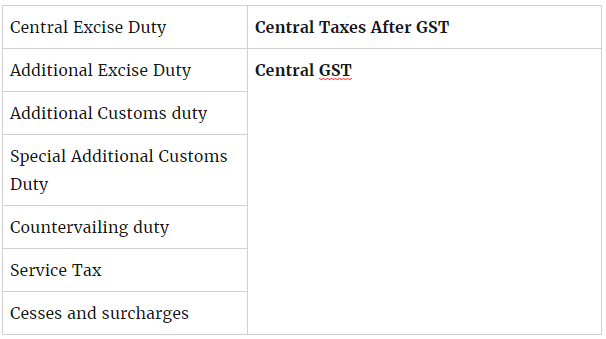

What’s on now?

- The Centre and states levy multiple taxes such as excise duty, octroi, central sales tax (CST), value added tax (VAT), octroi, entry tax among others.

The Framework

- GST will subsume all local and central indirect taxes (except customs duty).

- Under current laws only the Centre can impose a tax on services.

- GST will empower states to collect service taxes

The Working

- The states and the Centre will collect identical rates of taxes on goods and services

- If 18 percent is the GST rate on a good across the country, the states and the Centre will get 9 percent each called the CGST and SGST rates.

Tax Rates

- All goods and services have been placed under four slab rates – 5, 12, 18 and 28 percent – along with a cess on luxury and demerit goods such as tobacco, pan masala and aerated drinks. Most services, except those in the negative list of essential services such as healthcare and education, will come under GST.

Another Tryst With Destiny! How GST Will Change Your Life After July 1

States' Fiscal Powers

- GST offers a compensation package to states for potential revenue loss up to 5 years.

- Under GST rules, states will be fully compensated up to five years for potential revenue loss, with 2015-16 as the base year for calculating revenue assuming a secular or long-term growth rate of 14 percent.

Consuming V/s Producing States

- GST will be levied at the place where goods and services are consumed.

- This can potentially give more revenues to consuming states such as UP, Kerala and West Bengal compared to producing or industrialized states such as Maharashtra, Gujarat or Tamil Nadu.

Petro Products?

- Five petroleum products –crude oil, petrol, diesel, natural gas and aviation turbine fuel have temporarily been kept out. The GST Council shall decide the date from which they shall attract GST.

- The existing taxation system (VAT & Central Excise) will continue on petroleum products.

Alcohol

Alcohol have been kept outside GST, and the existing state and central levies will continue.

IT Backbone

- A robust IT backbone being set up to make GST implementation seamless across state boundaries.

- Common portal providing 3 core services:

- Registration

- Returns

- Payment

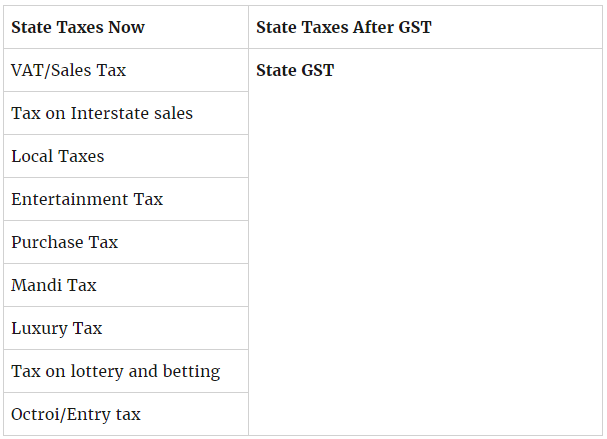

Price Impact

- The impact on prices is unknown

- Nobody is quite sure whether prices will rise, fall or remain the same after GST, which partly explains the jostle to drain out old stocks at heavy price markdowns.

- Most electronic gadgets, for instance, have been placed in the 28 percent GST slab, marginally higher than the current effective tax of about 27 percent—15 percent local VAT (value added tax) plus around 12 percent central excise duty.

- The system of input tax credit (ITC), however, has queered the pitch, which may eventually bring down prices, despite a higher GST rate than the current effective tax rate.

- Input credit means at the time of paying tax on output, a producer, trader or service provider can reduce the tax already paid on inputs.

- An ‘anti-profiteering’ clause has been provided in the Centre GST (CGST) and State GST (SGST) laws, to ensure that business passes on the benefit of reduced tax incidence on goods or services to the consumers.

- Such a framework will ensure that companies don't arbitrarily raise prices of goods just before or after the implementation of GST from July 1.

- The Centre has maintained that new tax rates will not push up inflation and the body will be keep a check price rise caused by profiteering.

GST: What could get costlier, what could get cheaper

Here’s how prices of goods could move after the new GST rates kick-in from July 1, 2017.

Cheaper Meals?

A restaurant bill now is a complex jumble of food costs, taxes on food and alcohol and services, cesses and service charges. After GST, you may expect eating out to be cheaper as a single tax will replace a welter of levies.

Costlier Calls

Your phone calls may become costlier. Phone bills will likely attract an 18 percent GST rate compared to the current 15 percent (including cesses).

Free state-borders

GST will subsume most state local levies, including the entry tax or octroi. Trucks will be able to move across state borders without queuing up for long hours to pay taxes. Municipalities and local bodies, however, can continue to collect local taxes. Brihanmumbai Municipal Corporation have, however, lifted the entry taxes for entering Mumbai after GST.

Costlier Services

Currently most services are taxed at a standard rate of 15 percent; these will turn costlier as the standard service tax rate is expected to go up to 18 percent.

----------------------------

GST impact: Full list of cars, bikes that will become cheaper from tomorrow

GST: 11 years, three governments, three FMs

Here’s a look back at how GST, independent India’s biggest reform initiative, has reached the final leg:

----------------------------

2006 - FM P Chidambaram moots GST in the Budget Speech for 2006-07.

2008 - Empowered Committee of State Finance Ministers (EC) engaged.

2009 - EC releases its First Discussion Paper

2011 - FM Pranab Mukherjee introduces Constitution Amendment Bill on GST in Lok Sabha

2013, August- Parliamentary Standing Committee submits report on GST; recommendations incorporated in the Bill

2013, September - Revised Bill sent to EC for consideration

2014, March - Another revised Bill drafted incorporating recommendations of EC.

2014, Dec - FM Arun Jaitley introduces Constitution Amendment Bill for GST in Lok Sabha.

2015, May - LS Passes Constitution Amendment Bill for GST.

2015, Aug - Congress insists on capping GST rate at 18 percent; opposes 1 percent “entry” tax to protect manufacturing states as it distorts the system.

2016, July - Centre and states agree against capping GST rate in the Constitution amendment Bill.

2016, Aug - Parliament passes 122nd Constitution Amendment Bill for GST; clause on entry tax dropped; states assured of full compensation for potential revenue loss upto five years.

2016, October 18 - GST Council decides on a compensation formula for states for revenue loss.

2016, October 26 - FM Arun Jaitley writes blog favouring four-tiered GST tax structure.

2016, November 03 - GST Council agrees on a four-slab structure –5, 12, 18 and 28 percent—along with a cess on luxury and `sin’ goods such as tobacco.

2016, November 04 - GST Council meeting inconclusive as Centre, states fail to agree on GST administrative issue on “dual control”

2016, November 12 - GST Council fails to agree on CGST and SGST laws

2016, Dec 23 - Agreement on two laws in GST Council meeting, but “dual control” remains a thorny issue.

2017, Jan 03 - States want compensation corpus raised from Rs 55,000 crore to Rs 90,000 crore to soothe demonetisation pain; new roadblocks surface on taxation rights of goods transported through territorial waters.

2017, Jan 04 - No breakthrough in GST Council meeting, hopes hinge on Jan 16 meeting to break impasse; roll-out date pushed till July 1.

2017, Jan 16 - Centre and states agree on two thorny issues of “dual control” and taxing rights of goods moved through high seas.

2017, Feb 18 - GST Council finalizes draft Compensation Bill.

2017, Mar 4 - GST Council approves CGST and IGST) Bills.

2017, Mar 16 - GST Council State GST Bill and the UT GST Bills.

2017, Mar 20 - Union Cabinet approves CGST, IGST, UT GST and Compensation Bills.

2017, March 27 - FM Arun Jaitley introduces CGST, IGST, UT GST

2017, March 29 - Lok Sabha passes five GST bills.

2017, March 31 - GST Council approves five sets of rules involving registration, payment, refund, invoices and returns.

2017, May 18 - GST Council meets in Srinagar; approves tax rates for 1211 items; approves another four sets of rules relating to composition, valuation, ITC (input tax credit) and the transition process.

2017, May 19 - GST Council places services under four slabs—5,12,18,28 percent.

2017, June 03 - GST rate of gold fixed at 3 percent; footwear placed in two tax slabs—5 percent for footwear less than Rs 500 and 18 percent for more.

2017, June 11 - GST Council reduces tax rates on 66 items including ketchups, instant food mixes, pickles, tractor components, computer printers and insulin among others; announces a two-part entertainment tax for cinema. Movie tickets costing Rs 100 or below will attract a GST rate of 18 percent, while those priced at above Rs 100 will be taxed at 28 percent.

2017, June 18 - GST Council extends deadline for the first set of returns; lotteries to be taxed at 28 and 12 percent; relief for hotels as 28 percent rate will apply for room tariffs above Rs 7,500 a night.

2017, June 20 - FM Arun Jaitley announces plans for a midnight event in Parliament’s central hall on June 30 to roll out goods and services tax (GST).

2017, June 30 - A midnight event in Parliament’s central hall will mark the switchover to GST.

------------------------------------

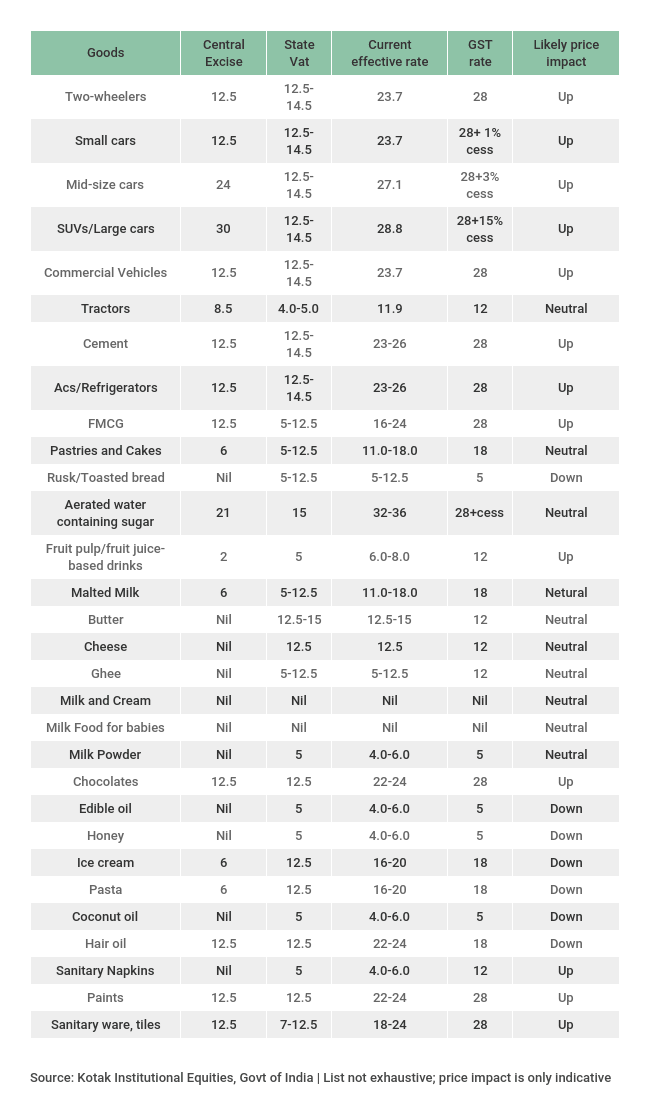

GST Rates Across the World

India shortly join a long list of more than 100 countries to introduce a nation-wide Goods and Services Tax (GST) or national Value Added Tax (VAT).

Here’s a summary of rates charged in different countries and the years when GST kicked-in across the world.

| Country# |

Standard VAT/GST rate in % |

Other rates in % |

Introduced in year |

| France |

20 |

10,5.5,2.1 |

1954 |

| Germany |

19 |

7 |

1968 |

| Netherlands |

21 |

6,0 |

1969 |

| Italy |

22 |

10,5,4 |

1973 |

| Argentina |

21 |

27,10.5,0 |

1975 |

| Korea |

10 |

0 |

1977 |

| Mexico |

16 |

0 |

1980 |

| Indonesia |

10 |

0 |

1984 |

| New Zealand |

15 |

0 |

1986 |

| Japan* |

8 |

0 |

1989 |

| Russia |

18 |

10,0 |

1991 |

| South Africa |

14 |

0 |

1991 |

| Singapore |

7 |

0 |

1994 |

| China |

17 |

13,11,6,5,3 |

1994 |

| Australia |

10 |

0 |

2000 |

| Malaysia |

6 |

0 |

2015 |

| India |

18 |

5,12,28 |

2017** |

|

*Consumption tax

|

|