Seven ITR forms are available for you to file returns. Complete disclosure of your income is not enough. Make sure you use the correct form, too

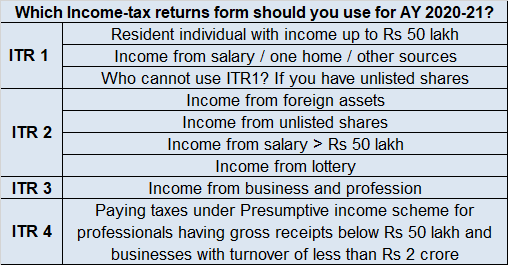

One size doesn’t fit all they say. The case with tax forms is no different. There are seven different Income Tax Return (ITR) forms for assessees to file their return for the assessment year 2020-21. Out of these seven forms, five can be used by individual taxpayers, depending on their income level, sources of income and other rules. Selecting the correct ITR form is very important, as filing a return with the wrong ITR form is considered as null and void by the income tax department. Read on to know the right form that you need to use.

Salary and other income upto Rs 50 lakh? Use ITR-1

ITR-1 is the most used form among the seven. Just to give you an idea of its use, during assessment year (AY) 2019-20, about 3.3 crore people used ITR-1 to file their returns, out of about 6.78 crore total returns filed – almost 50 per cent. ITR-1 can be used by a resident individual assessee and a Hindu Undivided Family (HUF) with a total income of up to Rs 50 lakh during the financial year 2019-20. This total income includes income from salaries or pension, one house property, other sources (interest on bank deposit and so on), and agricultural income of up to Rs 5,000.

However, this form cannot be used by an individual who is either a director in a company or has invested in unlisted equity shares. Besides these, a person who is a non-resident or not ordinarily resident, or a person who has income from business or profession or owns more than one house property cannot use ITR-1 to file the tax return. There are a few more cases in which this ITR form cannot be used by an individual.

Income from foreign assets or unlisted shares? Use ITR-2

ITR-2 in most cases is an extension of ITR-1. Those who cannot use ITR-1 typically fit into ITR-2. The ITR-2 can be used by those individuals and HUFs who have income from salary or pension (even if it exceeds Rs 50 lakh), and/or income from house property (one or more) in the previous financial year. One can also use ITR-2 to file returns if income includes winning a lottery or there is income from owning and maintaining a race horse or income taxable at special rates.

Also, an assessee who had investments in unlisted equity shares at any time during the previous financial year, or an individual who is a director in a company, can use ITR-2.

Some of the others who can use ITR-2 are those who have Resident and Ordinarily Resident (ROR) or Resident but Not Ordinarily Resident (RNOR) status, apart from non-resident Indians (NRIs). If someone has income in the form of capital gains, holds or has earned income from foreign assets or entity, has income of more than Rs 5,000 from agriculture, then that person too can use ITR-2 to file tax returns.

But ITR-2 cannot be used by someone who had income from profits and gains of business or profession or who is a partner in a partnership firm and has income from that partnership.

Doctor, lawyer, consultant, or income from any profession? Use ITR-3

ITR-3 can be used by an individual or a HUF who has income from a profession or a business. For instance, a doctor, a lawyer or a shopkeeper can use this form to file tax return. Irrespective of whether the person is non-resident or resident (ROR/RNOR) can use this form to file a return. Also, those who have income from salary, pension, house property, or capital gains, besides income from profession and business can use ITR-3 to file the return.

However, companies, trusts, co-operative societies and firms including LLPs are not allowed to use ITR-3 form to file return of income.

For presumptive income, use ITR-4, but mind the caveats

ITR-4 can be used by both resident individuals and HUFs who had income either from profession or from business in the previous financial year, but want to adopt the presumptive income scheme (PIS) to calculate their income tax liability. According to Sections 44AD, 44AE and 44ADA of the Income Tax Act, 1961, PIS can be used by businesses that had a total turnover of less than Rs 2 crore, and by eligible professionals with gross receipts of less than Rs 50 lakh during the previous financial year. The main advantage of opting for PIS is that you are not required to maintain books of accounts.

Under PIS, businesses can estimate their net income at the rate of 6 per cent of the total turnover, if gross receipts are received through digital mode of payments; or at the rate of 8 per cent in case of cash receipts. On the other hand, professionals like doctors, lawyers, architects and interior designers who opt for PIS have to declare 50 per cent of the total receipts during the fiscal as profit and get it taxed accordingly. However, both business owners and professionals can voluntarily declare their income at a higher rate than mandatorily required under the scheme.

Remember, if a person’s business turnover exceeds Rs 2 crore, one cannot opt for PIS, and then ITR-3 will be applicable instead of ITR 4. Besides that, the total income to file return using ITR-4 should not exceed Rs 50 lakh.

Also, those who wish to set off expenses with income earned cannot opt for PIS and thus ITR-4 will not be applicable. Others who cannot use ITR-4 include those having more than one house property (whether let out or self-occupied), who had agricultural income in excess of Rs 5,000, who were a director in a company, held any unlisted equity shares at any time during the previous year, had financial interest in assets located outside and loss under income from other sources and so on.

Who can use ITR-7?

ITR-7 can be filed by any person or company that is required to file tax return under Section 139(4A)—income from a property held by a trust, Section 139(4B)—income derived by a political party, Section 139(4C)—entities such as scientific research associations, educational institutions, hospitals and other medical institutions, news agencies, and so on and Section 139(4D)—returns by colleges, universities or any other.

|